What Is Bitcoin?

Bitcoin is a decentralized digital currency, created in 2009 by an anonymous individual or group using the pseudonym Satoshi Nakamoto. Unlike traditional currencies issued by governments and regulated by central banks, Bitcoin operates on a peer-to-peer network using blockchain technology to record transactions securely. Its scarcity, cryptographic security, and mathematical foundation give it value and trust among users.

Understanding Bitcoin

Bitcoin is not a tangible coin but a digital representation of value. At its core, Bitcoin is based on mathematical principles, cryptography, and game theory. Each Bitcoin transaction is validated through complex mathematical algorithms by nodes (computers) on the Bitcoin network, making it extremely difficult to forge or duplicate.

The network operates without a central authority, relying instead on consensus among distributed nodes. Transactions are bundled into blocks, and each block is linked to the previous one, creating a secure, immutable ledger - known as the blockchain.

Why would anyone want Bitcoin instead of "normal" money? Actually, the normal money we use is quite unusual. Historically, money was made of precious metal like gold and sliver. Today? Not any more. We get money made of printed paper, with small print saying something like "I promise to pay the bearer on demand the sum of ten dollars." That promise does not mean much if you consider that the government can just print more money if they want.

And they may actually do so for various reasons. As more and more money is created, the value of existing money drops. People will start to feel this when their shopping, eating and watching costs more and more.

Bitcoin is different. The supply is controlled and cannot be created at freely. There can only be 21 million bitcoins. This prevents the kind of erosion of value that we see in 'normal' money.

How Bitcoin Started

Bitcoin was introduced through a whitepaper titled "Bitcoin: A Peer-to-Peer Electronic Cash System," published by Satoshi Nakamoto in 2008. The motivation behind Bitcoin was to create a form of digital money that didn't require trust in banks or third-party intermediaries. It was launched during the aftermath of the 2008 global financial crisis, a time when trust in traditional financial systems was low.

The first implementation of Bitcoin was released as open-source software in January 2009, allowing anyone to participate in the network.

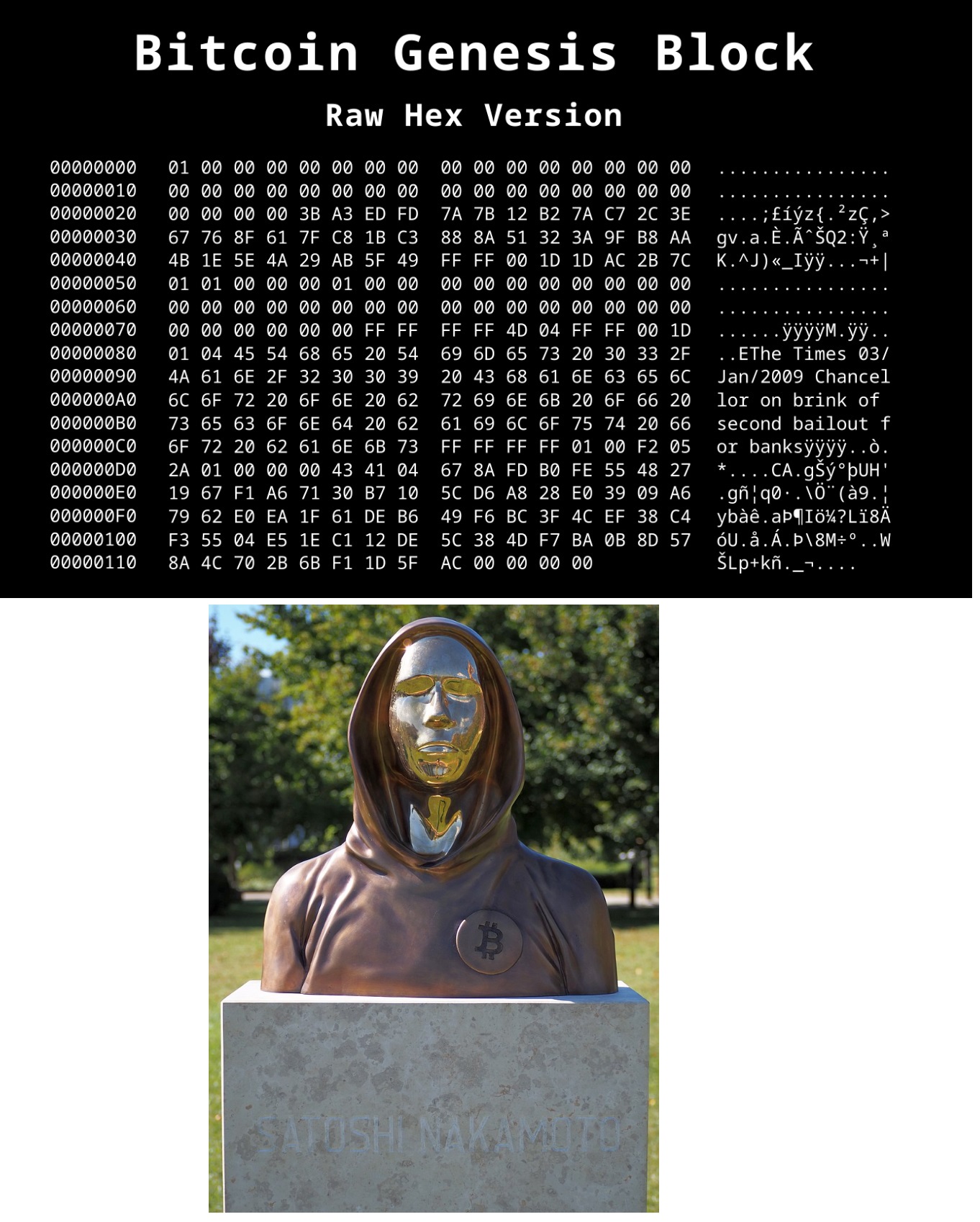

First Block

The genesis block, also known as Block 0, was mined by Nakamoto on January 3, 2009. Embedded in the coinbase parameter of this block was a message referencing a headline from The Times: "The Times 03/Jan/2009 Chancellor on brink of second bailout for banks." This message served both as a timestamp and a critique of the banking system, emphasizing Bitcoin's purpose.

Block 0 contained 50 Bitcoins, which were not spendable due to hardcoded software rules. It laid the foundation for the blockchain network.

Rewards

Bitcoin miners are rewarded for validating transactions and adding new blocks to the blockchain. This reward serves two purposes: incentivizing mining and issuing new Bitcoins into circulation. The initial reward was 50 Bitcoins per block, and this amount is halved approximately every four years in an event called the "halving."

- 2009: 50 BTC

- 2012: 25 BTC

- 2016: 12.5 BTC

- 2020: 6.25 BTC

- 2024: 3.125 BTC

This geometric progression ensures that the total supply of Bitcoin will never exceed 21 million, a limit encoded in the protocol.

Denominations

Bitcoin can be divided into smaller units, making it practical for microtransactions:

- 1 Bitcoin (BTC) = 1,000 millibitcoins (mBTC)

- 1 BTC = 1,000,000 microbitcoins (µBTC or bits)

- 1 BTC = 100,000,000 satoshis

The smallest unit, the satoshi, is named after Bitcoin's creator. This granularity allows for fine precision in pricing and payments, crucial for usability as the currency appreciates in value.

How to Buy Things Using Bitcoin

To make a purchase with Bitcoin:

- The buyer scans a merchant's QR code or enters their Bitcoin address.

- The buyer enters the payment amount and confirms the transaction.

- The transaction is broadcast to the Bitcoin network.

- Once verified by miners and added to the blockchain, the payment is considered complete.

Bitcoin transactions usually take 10 minutes to an hour to confirm, depending on network congestion and the fee paid. Many merchants use payment processors like BitPay to automatically convert Bitcoin to fiat currencies, mitigating volatility risk.

Blockchain

The blockchain is a decentralized ledger consisting of sequential blocks. Each block contains:

- A timestamp

- A reference (hash) to the previous block

- A list of validated transactions

- A nonce (used in mining)

The security of the blockchain is rooted in its use of cryptographic hash functions, particularly SHA-256. The hash of each block must meet a certain criterion (number of leading zeros), which requires miners to perform a brute-force search to find the correct nonce. "Nonce" is is an arbitrary number that can be used just once in a cryptographic communication. Finding this is a computationally expensive process known as Proof of Work (PoW).

Encryption

Bitcoin uses a combination of cryptographic algorithms:

- SHA-256: Used for hashing blocks and transaction IDs.

- ECDSA (Elliptic Curve Digital Signature Algorithm): Ensures ownership and authenticity of transactions.

Each user has a private key (secret) and a public key (shared). Transactions are signed with the private key and verified with the public key, proving that the sender has the authority to spend the Bitcoins without revealing their identity.

How to Buy Bitcoin

To buy Bitcoin:

- Choose a cryptocurrency exchange (e.g., Coinbase, Binance, Kraken).

- Create and verify an account.

- Deposit fiat currency (USD, SGD, etc.) via bank transfer, credit card, or PayNow (in Singapore).

- Use the deposited funds to buy Bitcoin.

- Transfer the purchased Bitcoin to a personal wallet for security.

Users can also use peer-to-peer (P2P) platforms to buy directly from other individuals.

How to Mine Bitcoin

Bitcoin mining involves solving complex mathematical puzzles using computer hardware. The goal is to find a nonce that, when hashed with block data, produces a hash lower than the target value set by the network. This process requires:

- Specialized hardware (ASIC miners)

- Mining software (CGMiner, BFGMiner)

- Electricity

- A mining pool (optional, for increased odds of rewards)

Mining verifies transactions and adds them to the blockchain while introducing new Bitcoins into circulation.

Options for Successful Mining

- ASIC Miners: Application-Specific Integrated Circuits are the most efficient mining hardware.

- Mining Pools: Groups of miners combine resources to increase the chance of solving blocks and share the rewards.

- Cloud Mining: Renting mining capacity from data centers, though this can be risky due to scams.

- Location: Mining is more profitable in regions with low electricity costs and cool climates to prevent overheating.

Success in mining also depends on hash rate (computational power) and energy efficiency.

How to Use Bitcoin

Once you own Bitcoin, you can:

- Store it in a wallet (hardware, software, or paper).

- Send it to others via their public address.

- Spend it on goods and services.

- Invest or trade on cryptocurrency exchanges.

Wallets generate and store your private keys, allowing you to securely access your Bitcoins.

Using Bitcoin for Payment

Many companies accept Bitcoin payments, including:

- Online retailers (Overstock, Newegg)

- Travel services (Travala, CheapAir)

- Charities

- Local vendors in tech-forward cities

To pay with Bitcoin, use a wallet app to scan a QR code and authorize the transaction. Bitcoin's low transaction fees (compared to credit cards) are appealing to merchants, although price volatility can be a concern.

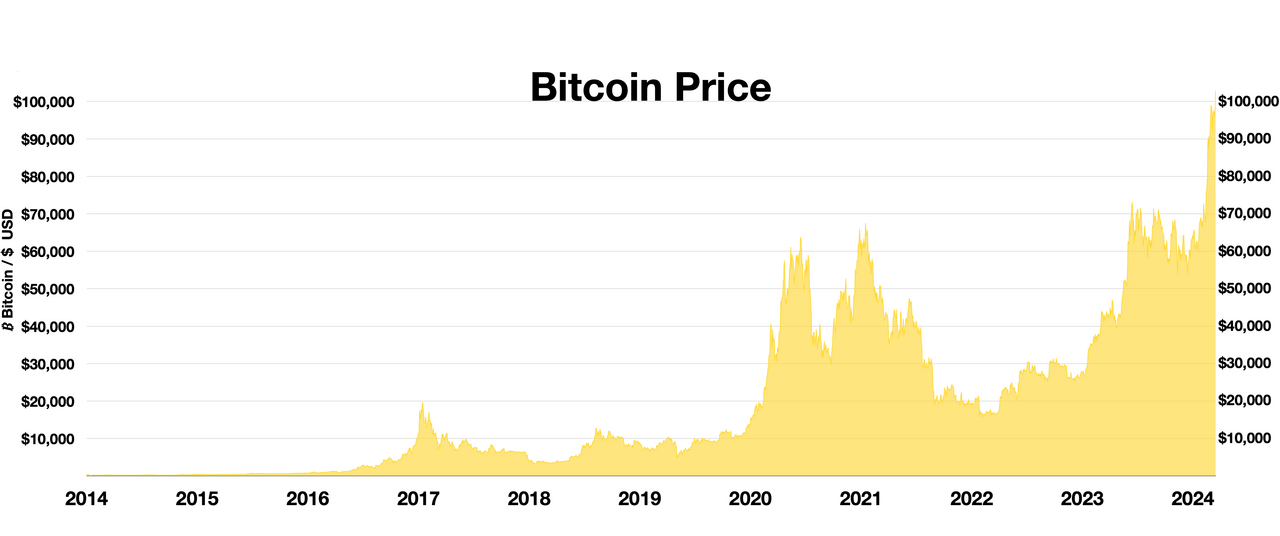

Investing and Speculating

Bitcoin is often viewed as "digital gold" due to its limited supply and deflationary model. Investors hold Bitcoin as:

- A hedge against inflation

- A store of value

- A speculative asset with high growth potential

Bitcoin can be bought and held long-term (HODLing) or traded for short-term profits. Derivatives like Bitcoin futures and ETFs provide additional exposure.

Risks of Investing in Bitcoin

- Volatility: Bitcoin's price can swing wildly in short periods.

- Regulatory Risk: Governments can impose bans or regulations that affect its legality and utility.

- Security Risk: Hackers target exchanges and wallets. Storing Bitcoin in cold wallets (offline) is safest.

- Irreversible Transactions: Mistakes or fraud cannot be reversed once funds are sent.

- Market Sentiment: Prices are heavily influenced by news, speculation, and public opinion.

Investors should perform due diligence and only invest what they can afford to lose.

Bitcoin Regulation

Bitcoin's legal status varies globally:

- Legal and regulated: United States, Singapore, Switzerland

- Restricted: China, India, Turkey

- Banned: Algeria, Morocco, Bangladesh

In Singapore, Bitcoin is not legal tender but is regulated under the Payment Services Act by the Monetary Authority of Singapore (MAS). Businesse s must obtain licenses to provide crypto services, and Know-Your-Customer (KYC) rules apply.

How Much Is $1 Bitcoin in Singapore Dollars?

The value of Bitcoin is highly volatile and changes by the minute. As of the latest data, if 1 BTC is trading at SGD 90,000, then:

- $1 BTC (one U.S. dollar worth of Bitcoin) = 1 / 90,000 = 0.0000111 BTC

- In Singapore dollars, $1 worth of Bitcoin = SGD 1.35

To calculate this accurately:

- Check the current BTC/SGD exchange rate from platforms like CoinMarketCap or Binance.

- Multiply your Bitcoin holdings by the current rate to get the SGD equivalent.

Conclusion

Bitcoin is a revolutionary digital currency rooted in complex mathematics, cryptography, and decentralized principles. From mining and blockchain mechanics to practical applications and investment potential, Bitcoin represents a new era of financial innovation. However, it is not without risks. Understanding its underlying structure and usage is crucial for anyone entering the cryptocurrency world - whether as a buyer, seller, investor, or developer.

You can learn these concepts and more at Dr Hock's maths and physics tuition.